Incubator Investment Fund

Incubator Investment Fund is a Cyprus private equity fund addressed to well informed investors1 incorporated under the Cyprus Companies Law and authorized by the Cyprus Securities and Exchange Commission (CYSEC) to operate as a Cyprus Alternative Investment Fund in the form of a limited liability company by shares, as open-ended investment company of variable capital as provided in the Cyprus Alternative Investment Funds Law.

Cyprus private equity investment Fund’s Objective

Cyprus private equity investment Fund objective is to invest in Cyprus private equity investment opportunities and abroad aiming to achieve long-term capital growth to well Informed Investors1 by investing all or substantially all of its assets in fundamentally strong private equity projects in the following sectors:

- Real estate

- Financial services and banking

- Conventional mining

- Conventional commodity trading and agriculture

- Digital technology

- Manufacturing and general industry

- Energy

- Other

Cyprus Investment Fund private equity Investment Strategy

The Cyprus private equity investment fund seeks to provide project development and construction finance to private equity investment project companies with satisfactory investment yields in the target industries in the target countries and to benefit from income in respect of its private equity investment and/or realize the capital gains generated in respect of its private equity investment after a long period of time or if an adequate opportunity to sell the private equity investment project company arises after completion.

Furthermore the private equity investment Fund will invest in Cyprus private equity of investment subsidiaries and abroad holding or acquiring to hold all licenses, permits, concessions and contractual entitlements necessary to build and operate a private equity investment project.

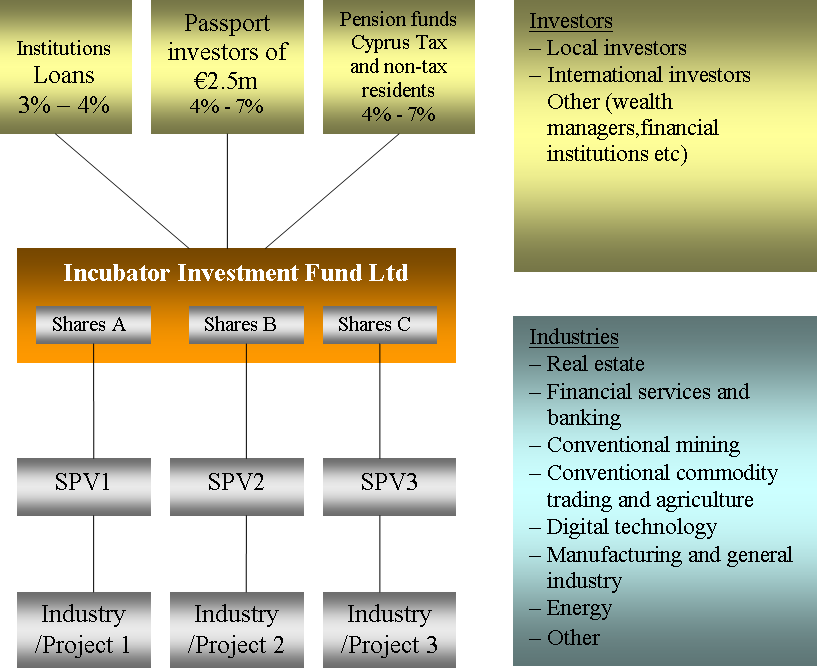

The Cyprus investment Fund will mainly invest directly or through special purpose vehicles ‘companies’ (‘SPVs’) and intermediary holding companies depending on the requirements of the law, tax considerations and commercial purposes for the best benefit of the Fund and its investors. The companies including their assets are owned by the Fund.

Cyprus investment private equity investment fund structure

Distribution Policy of the Cyprus private equity Fund

No dividends will be declared in respect of the Participating Shares. Income earned by the Fund will be re-invested and reflected in the value of the issued Participating Shares of the relevant Class. Distribution to shareholders will take the form of shares redemption on every 1st of January and on every 1st of July respectively.

In accordance with its Articles of Association, the Cyprus investment Fund will keep separate books of account and records for each Share Class and will issue Net Asset Value for each respective Class of Participating Shares.

Classes of shares

The Cyprus Investment Fund splits its activities to various compartments – each representing different Class of shares. The proceeds from the issue of each class of share shall be applied to the Class to which that share forms part of, and the assets and liabilities and income and expenditure attributable thereto shall be applied to such Class. Any increase or decrease in value of respective Class assets shall be applied to such relevant Class of shares.

The Cyrus private equity Fund currently launches two classes of shares. Class A Participating Shares related to any type of private equity investment in Cyprus and Class B Participating Shares related to any type of private equity investments abroad.